The allure of real estate as an investment is undeniable. However, directly owning property comes with challenges like management responsibilities and significant upfront capital. Enter Real Estate Investment Trusts (REITs), Read More

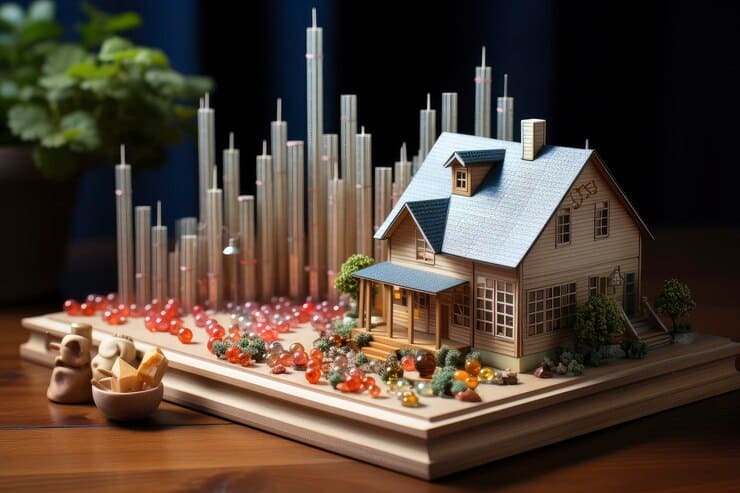

What are REITs? Imagine companies that own, operate, or finance income-generating real estate across various sectors like office buildings, apartments, shopping malls, hospitals, and more. These companies are REITs. They pool capital from investors and use it to acquire and manage real estate portfolios. By investing in a REIT, you gain exposure to the real estate market without the hassle of directly buying, managing, or financing individual properties. How Do REITs Work? REITs generate income through rent payments from tenants or interest earned on mortgages they hold. By law, most REITs are required to distribute a significant portion (around 90%) of their taxable income to shareholders in the form of dividends. This makes them attractive to investors seeking regular income streams. Types of REITs There are two primary categories of REITs: Benefits of Investing in REITs Things to Consider Conclusion REITs offer a compelling option for investors seeking exposure to the real estate market without the burdens of direct ownership. By understanding the different types of REITs, their benefits, and potential drawbacks, you can determine if they align with your investment goals and risk tolerance. Remember, consulting with a financial advisor can help you make informed decisions when incorporating REITs into your investment portfolio.

Building Wealth Through Real Estate: Unveiling Real Estate Investment Trusts (REITs)

The allure of real estate as an investment is undeniable. However, directly owning property comes with challenges like management responsibilities and significant upfront capital. Enter Real Estate Investment Trusts (REITs), Read More